Introducing the RISC™ Index: the 'credit score' of rental popertiesReal Estate Investment Risk Analysis

RISC™ Index Explained

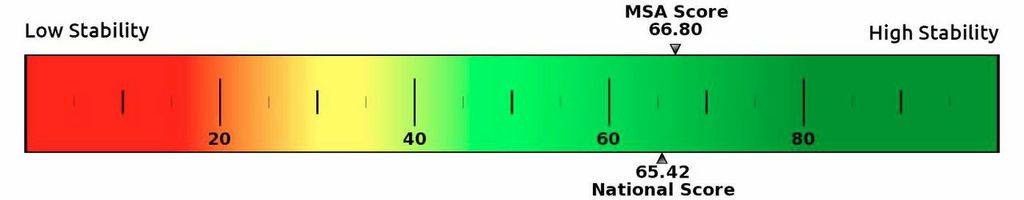

The Rental Income Stability Composite (RISC™) index is the nation’s first and only location risk score for residential income property. Ranging from a low of 1 to high of 100, the RISC score offers a fast and simple metric for the relative impact that demographics, crime, schools, economic and other location-based data have on the stability of income generation from residential rental property. Applicable throughout the United States, the proprietary analytics of the RISC index utilize real-time feeds from the country’s leading data providers offering amazing real estate investment risk analysis.

A single composite index for comparative evaluation and screening of rental properties

Risk Report

Risk Detailed Report

Real Estate Investment Risk Analysis

View Our Real Estate Rent Report Page for Related Information

Run Your First Report Free

Know your risk today before you buy your next rental property.